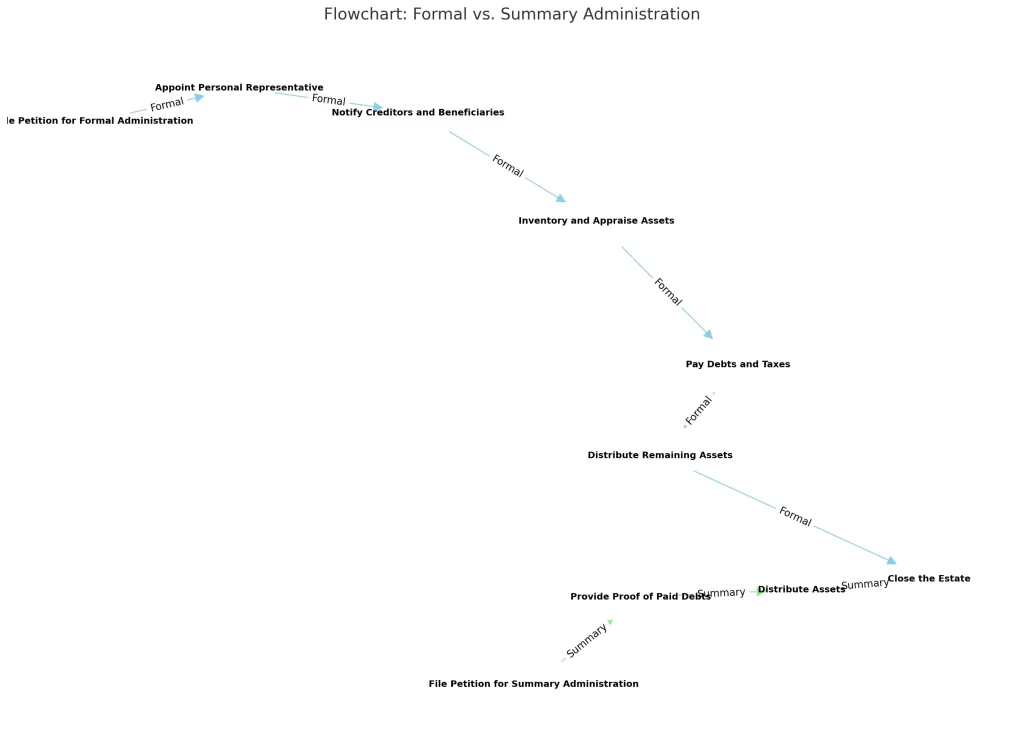

Formal administration in Florida is a crucial probate process required for estates exceeding $75,000 in non-exempt assets.

Understanding Formal Administration in Florida

I have done hundreds of probate administrations. Let me show you what I have learned. Here’s formal administration from my attorney point of view. We’ll cover avoiding formal administration, homestead, refrigerators with Wi-Fi, car collections, Publix stock benefits, probate from the insurance company’s perspective, and the dreaded 90 day publication in the newspaper that feels like an eternity. If you want to talk about this stuff in person, set up a no obligation consultation with me at one of my offices by calling (305)634-7790.

The Basics

According to Florida Statute XXXXXXX, formal administration is required when beneficiaries are receiving over $75,000 in assets (not including the homestead) and it has been less than two years since the decedent passed away.

Here’s formal administration from my attorney point of view.

Many people prefer to do the shorter, summary administration process. That makes sense to me. So let me take you behind the scenes and show you what I do, as a legal practitioner, to zealously represent my clients to get a case out of formal administration into summary administration.

Exempt Assets

Homestead is Exempt

The decedent’s home (primary residence) is exempt because of the Florida constitution.

Now when I heard about the $75,000 limit, I thought to myself, does that mean people who are inheriting a home don’t qualify for a quick summary administration just because the value of the house is worth more than the $75,000 cap? It turns out that normally it’s ok. The way it works is because the home is the decedent’s primary residence, it’s considered a homestead and a homestead does not count when you’re considering the $75,000 limit. The homestead is technically not part of the estate because it passes to the beneficiaries through law provided by the Florida Constitution Article XXXXXXXXX.

Dying Outside of the Home Can Be OK

In the past, I wondered does the homestead status get lost if the decedent left their home to go to an assisted living facility? I also wondered, what if the decedent started staying at their children’s home because they had trouble taking care of themselves because their children were giving them end-of-life medical treatment and care? Does that mean that their home doesn’t qualify for the Homestead exemption from being included in the total value when determining whether you must go for formal administration as opposed to summary administration?

It turns out that what I learned was it’s totally OK if it’s end-of-life medical care that takes you out of your home, you’re good.

Renting Out the House Can Be a Problem

On the other side of the coin, what if your home becomes someone else’s home because you rent the house out to somebody else? So, if the decedent moves out of the house and they rent that house out and that house is someone else’s home because they’re renting it, they’re paying for it, it’s their exclusive use of the property, then that isn’t the decedent’s home anymore. It’s considered an investment property. Investment properties are counted when you are calculating that $75,000 limit.

If you have had any renting going on in the home and want me to advocate on your behalf to get you the summary instead of the formal, please call me at (305)634-7790.

The Home is Not the Only Exempt Asset

Now, I teach my team that there are other items that we exempt just like the decedent’s home. So where it’s been less than 2 years since the decedent passed away and we’re looking at that $75,000 limit, there are certain items that don’t count towards that limit because I can make them exempt. To do this, I use a document titled Petition to Determine Exempt Property.

Florida statute XXXXXXXXXX lists the assets that are exempt.

The items that you can list on a petition to determine exempt property include $20,000 worth of household items that include furnishings, appliances, and furniture. Have you heard about the new refrigerator that has internal cameras so you can check what’s inside your fridge while you are at the grocery store trying to remember if you need to buy some more cheese? There is an oven that has a camera inside that alerts you to your phone when the cooking timer is up. Well, I can list these items and exempt $20,000 worth of them to help keep you under the $75,000 limit.

Cars Can Be Exempt Too

For a lot of people, the car is what would put them over the edge on the $75,000 limit. Cars have gotten more expensive. Well guess what, I can make it so you can inherit two Mercedes Benz S classes and it’s all exempt because you can inherit two cars and it doesn’t count against the cap as long as those are the decedent’s cars and they were used by the decedent or the decedent’s immediate family. I can set you up to get the cars inherited directly through the tag agency. I fill out the form. The car does not technically need to be listed in the probate according to Florida Statute XXXXXXXXX. This is a breath of fresh air for families where the decedent was a car collector.

My Six-Step Guide to Inheriting a Car Outside of Probate

Step 1: Locate the Car’s Title and Notify Parties

My Six Step Guide to Inheriting a Car Outside of Probate

Step 1: Locate the Car’s Title and Notify Parties

Step number one is to see the car’s title and notify everyone about the car. To do that, you need to get your hands on the VIN—the vehicle identification number. This number is essential for searching up the car’s history, as searching by the decedent’s name won’t work.

The fastest way to find the VIN is by checking the vehicle registration or insurance card. If those aren’t available, take a picture of the car’s dashboard, specifically the bottom left of the front windshield. If it’s hard to get a clear picture through the glass, try checking the door jamb—there’s often a sticker or metal plate there with the VIN. Once you have the VIN, go to jovalentino.com, select your inheritance county, [FEATURE IN DEVELOPMENT] and use the vehicle search icon to look up the car’s details. Check for lien information to see if the car is paid off or if there’s an outstanding loan. If the car is leased, I advise to stop making lease payments and arrange for the dealership to pick up the car. We also contact the insurance company to determine coverage, though in my experience, coverage typically ends with the decedent’s passing.

Step 2: Apply for the Motor Vehicle Title

Step two is to apply for the certificate of motor vehicle title. Go to jovalentino.com, select your inheritance county, and click on Motor Vehicle Certificate [Feature in Development]. Start by filling out the form: select Transfer under application type, request a certificate of title by mail, and fill in the necessary ownership details.

For joint ownership, you’ll need to decide if you want “and” or “or”. If you select and, both owners must sign off on selling the car. If you select or, only one owner’s signature is required. Skip the tenancy by the entirety and life estate boxes unless they apply.

Step 3: Fill Out the Car’s Information

Step three is to fill out Section 2 with the car’s details. If you’re transferring a license plate, put the number in. If you want a new plate, write “new.” Make sure to include the car’s weight—this can be found by Googling the curb weight. If it’s a heavy vehicle like a Cadillac Escalade (over 5,000 lbs), you’ll need to fill in the gross vehicle weight as well.

Skip sections like BHPCC (which applies to motorcycles) and van use unless applicable. Check the box for private use, and if it’s an electric car, check that too.

Step 4: Transfer of Inheritance

Step four involves filling out Section 5 for transfer type. Select Inheritance and fill in Court Order if you have one, although you generally don’t need a court order to inherit a car. The Florida Department of Highway Safety and Motor Vehicles approves these transfers with the proper documents, particularly the death certificate.

In Section 6, provide the odometer reading. You can do this by taking a picture of the odometer and filling in the numbers on the form. Skip Section 7, which applies to car dealers, and Section 8 which applies only if the car is from out of state.

Step 5: Avoid Sales Tax

Step five is crucial for saving money: In Section 9, check the box for Inheritance. This lets you skip paying sales tax on the car, which could otherwise be a 6% tax rate. Make sure to complete this section to avoid any unnecessary tax charges.

Step 6: Sign and Release Interest in the Car

Finally, step six is filling out Sections 12 and 13. In Section 12, write the name of the beneficiary who will be the new owner of the car, and have them sign and date the form. In Section 13, Release of Spouse or Heirs Interest, list the name of the decedent, the date of death, and whether the decedent had a will (testate) or not (intestate).

If there are multiple heirs, list each one, even if they won’t be receiving ownership of the car. You may need to attach an additional page if there are more than two heirs. Make sure that the names in Section 12 match the ones listed in Section 13.

That’s my guide to inheriting a car in Florida. If you want me to take care of it for you, just give me a call at (305)634-7790. I also made a video about how to inherit a car. I bet you will find it quite useful. The video is not up yet, because I have been told we have to release the videos one at a time to be professional about it. Here’s the link to my YouTube channel: https://www.youtube.com/@JOValentino

Educational Investment Account is Exempt

If you’re like me, you get excited by legal ways to avoid paying taxes so you can invest in your family’s future. That’s why I am happy to report that one more way to exempt property from the $75,000 limit and avoid formal administration is an IRS 529 plan. IRS 529 Plans are a tax-advantaged investment account that allows you to grow your money tax free. You can withdraw the money tax-free too so long as you are spending it on education expenses school tuition, student loans, books, etc…. In addition to all that, the 529 plan is an exempt asset like the cars above. In other words, the 529 plan does not count against the $75,000 limit when determining if you can do a quicker summary administration probate instead of a longer formal administration probate. The way I let the judge know that the 529 plan is exempt is I write a petition to determine exempt property.

Slain Teachers Payout Money is Exempt

Money paid out under this category is rare, thank goodness. It’s nevertheless true though. If you are a teacher killed in the line of duty, the State of Florida will pay money out to your estate to help ease the burden on your loved ones under Florida Statute XXXXXXXX.

My grandmother was a teacher. My mom is now retired from teaching. My sister is a school principal. My family is thrilled. I love teachers. I loved sitting at the front of the class and raising my hand. Teacher’s pet? Absolutely. The last thing that the State of Florida wants is the money they paid out to result in an unnecessarily complex inheritance for the family of the slain teacher, so the law says that this money is exempt too. I can include this payout in a petition to determine exempt property.

That’s what I have got to say on exempt property in Florida probate. I made a video about exempt property. I enjoyed making this one because we got to put two Mercedes Benz S Classes up on the screen. One car is black and the other car is beige. It tickles me to think of his and hers cars. I don’t know any couple that has two of the same model car in different colors, but I’d look forward to meeting them. The video is not up yet, because I have been told we have to release the videos one at a time to be professional about it. Here’s the link to my YouTube channel: https://www.youtube.com/@JOValentino

The Two Year Anniversary is Pivotal

Now I know we’ve gotten in the weeds a little bit about this $75,000 limit, but what I do is I remind my team, don’t forget about the 2 years. If it’s been over 2 years since the decedent passed away, you can inherit 10 houses and 10 Mercedes S class sedans. The key takeaway is this, as soon as you hit the two-year anniversary of the passing, there is no longer a $75,000 cap on your inheritance. You could theoretically inherit Elon Musk’s (Telsa) or Jeff Bezo’s (Amazon) estate after two years with summary administration.

Wealthy Folks Like Formal Administration

If you want to geek out with me a bit more, you actually would not want to do summary administration for those million dollar plus estates because millionaires have plans in place made by me that gets major tax write-offs that are only available by appointing a personal representative (AKA executor) which is only available in formal administration because the personal representative is going to have to make elections to the IRS that under the trust I set up to get preferred tax treatment and keep more money in their pockets. Call me to set up your Spousal Lifetime Access Trust (SLAT) (reduce estate tax exposure); Qualified Terminable Interest Property Trust (QTIP) (reduces estate tax exposure with stricter control); or your Charitable Remainder Unitrust (CRUT) (avoids capital gains taxes). The millionaire mindset is one that thinks long term about bringing the biggest amount of good to their families allowed under the law. That’s why you can hire me to shelter your assets to get free (government-paid) long term care so that you don’t get forced to sell your house or spend down your life savings so that you can live more comfortably and leave a more lasting legacy to your loved ones. Call me to set up Medicaid eligibility with a Medicaid Asset Protection Trust (MAPT). My number is (305)634-7790.

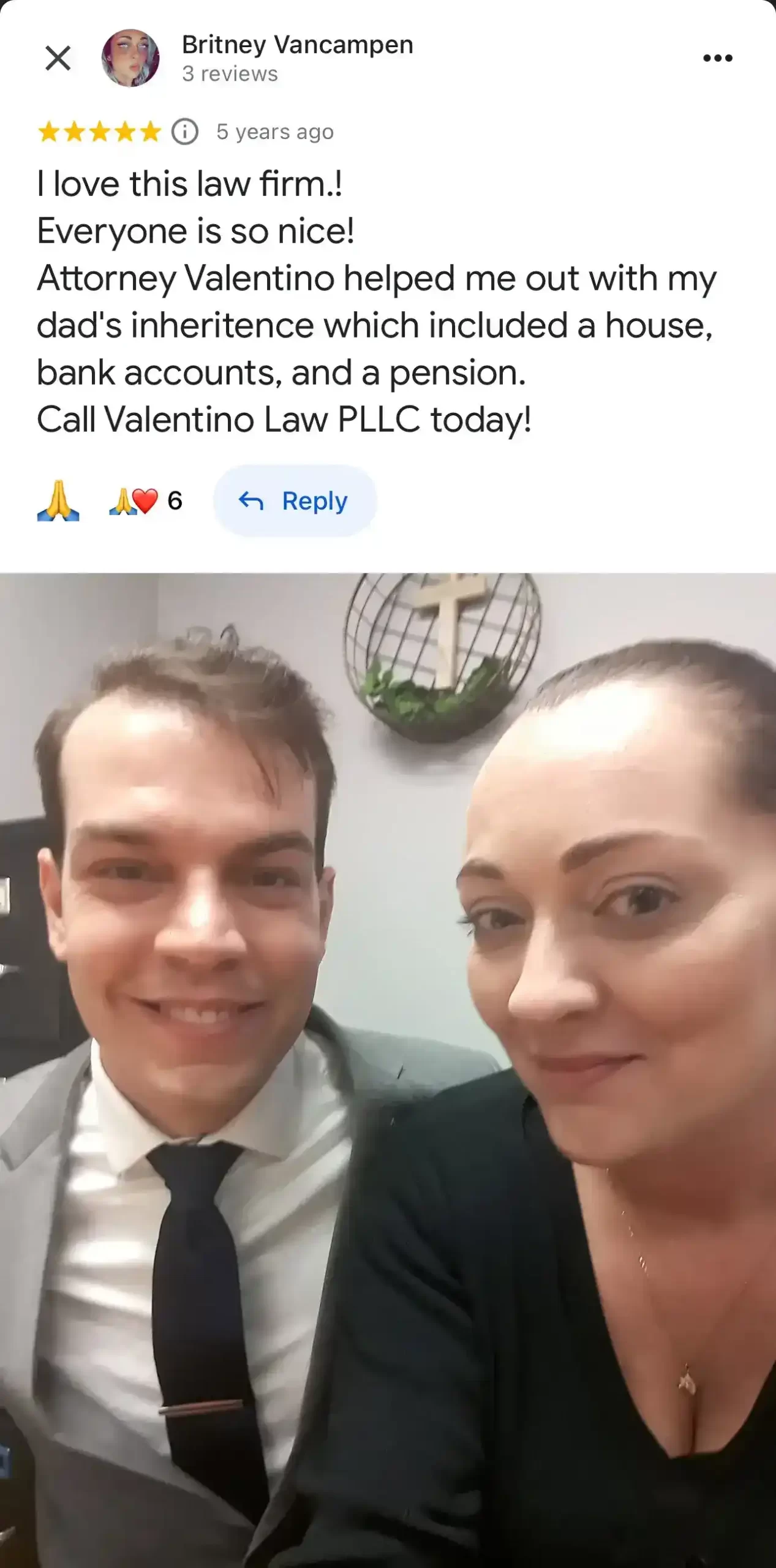

Publix Grocery Store Likes Formal Administration

Publix is a major employer in the state of Florida. They are great because they offer members of their team the ability to own a piece of the pie. And no, I’m not talking about the delicious bakery options available at Publix. Publix offers stock to its employees. It’s awesome. That is not so common in the world of butchers, bakers, and cashiers. We can all agree that there is a special place in heaven for the Publix team members that make those delicious pub subs and chicken wings. When someone who worked at Publix dies with stock, Publix is going to ask you to get a probate lawyer and get a personal representative appointed. I know we talked about the legal eligibility requirements required by the court, but this is different. This is Publix. I have gone through the process with them multiple times. They are friendly, but firm. They want a personal representative appointed. If you ask them why, as I did, they’ll tell you that they need binding signatures from someone who undoubtedly represents the estate of the decedent. The personal representative (AKA executor) is that person. Publix does care about the fact that the stock is worth $75,000 or less and can be resolved with summary administration. Publix does not care if it has been over two years since the decedent passed away and that the law allows you to skip the formal administration process for the quicker summary administration process. Publix has standards. If you love Publix, you love Publix’s standards. I grew up with Publix, I love it too. Publix wants to protect the stock of all of its shareholders. Publix wants to avoid legal disputes. If the court appointed personal representative signs the documents Publix requires than Publix can be sure that they are dealing with the right person. The last thing Publix wants is to authorize the stock sale, pay out the money and then get a letter from someone else later on saying they are the true beneficiary. Talk about a legal nightmare. That’s the great thing about formal administration, it’s official. It’s the highest level of probate.

Insurance Companies Love Formal Administration Too

I represent insurance companies in probate proceedings. I am a probate defense attorney. My wife and I appeared on the cover of the Florida Defense Lawyer’s (FDLA) magazine in 2024. We were standing on top of a mountain surrounded by industry professionals. I was a speaker at the FDLA’s premier convention in 2024. My topic was “Using Probate and Guardianship to Avoid a Failure to Settle.”

That’s what insurance companies care about, settling. By the time the insurance company brings me onto the case, they have decided to pay out the money under the policy. In fact, they send me the policy payout money as soon as they put me on the case. I have even been sent the money before I was put on a case. Imagine the secretary coming to you asking about a check with a big dollar amount on it and everyone in the office scratching their heads until we figured we had another case coming our way. I hold the money in my attorney trust account.

The insurance company wants to settle. They settle by obtaining a binding release of liability. For the insurance company to feel comfortable, they ask me to get a personal representative appointed. Just like Publix, who we discussed before, the insurance company has high standards. They want a document signed by a person who has official authority to bind the estate with their signature. It does not matter if the payout is more or less than $75,000. It does not matter if it has been two years or more. The insurance company wants a binding release of liability. The insurance company trusts the signed release as binding when they know the person who signed has been appointed as the personal representative of the estate. The last thing the insurance company wants is to pay out the money and then find out later that someone else has rights to the money instead. That’s the powerful thing about formal administration; it enables a personal representative be appointed to sign legally binding documents that get things done.

More Stuff about Formal Administration

The personal representative gets appointed by an order appointing personal representative. The authority that a personal representative has is listed in a sister order that is called the letters of administration. All the time, banks are asking for letters of administration of people who can resolve their inheritance of a bank account with a summary administration probate instead. Please don’t take legal advice from your banker. You may nevertheless need letters of administration to inherit an investment account (see Publix above).

Formal administration has an inventory that you’re obliged to file within a certain time of being appointed personal representative of the estate. The personal representative, as soon as they are appointed, has the authority to talk with bankers and others to determine what assets, if any, the decent has left to be inherited. Do you never want to leave your family guessing? Write your estate plan with me. Call (305)634-7790. I send these inquiry letters out to banks. When the bank sees my letterhead they tend to behave much better than if you went in by yourself.

The Publication Time Makes All the Difference

The formal administration takes me a minimum of 3.5 months to complete. The reason it takes so long is that Florida Statute XXXXXXX requires that the formal cases run an ad in the newspaper for 90 days inviting all creditors to file claims for money owed. You do not want to go slow with this process because the 90-day creditor period already chews up a lot of your time. The way I try to do it is I front load all my effort in getting the case opened ASAP so that I can get the 90-day publication up as fast as the newspaper will allow. The reason you need the case opened before the newspaper publication is that the clerk of court assigns a case number to the file. The newspaper needs that case number to include it in the publication. Once the publication is scheduled, then the time consuming part of it is done in my mind. At that point I am marking my calendar with the end in mind. I am trying to get everything done so we can close the case as soon as possible after the creditor period runs. It’s a point of pride to me to be organized in this way. My team is completely aligned behind this idea. If you think we are serious about getting formal administrations done quickly, you will love what we are capable of achieving in a summary administration. We are probate speed lovers.

So you know we’re really serious about quick resolution of formal administration, I have a poem that I use to align my team behind this goal. It goes like this:

No time is wasted, no delay,

Resolving estates without dismay.

Ninety days might feel so long,

But quick closure proves we’re strong.

Conclusion

Well, that’s a look behind the curtain to see what I have to say about formal administration probate in Florida. I have done formal administration all over the state because of my insurance company experience. Call me to set up your formal administration estate (305)634-7790. I will put my experience and established systems to work for you. My hope is that when you work with me you can tell I have done this literally hundreds of times. Find peace in that. My hope is that you’ll like me for your probate, and then love me for your estate planning, wealth planning, and Medicaid planning. Let me be your family counselor-at-law.

Call: (305) 634-7790

Email: JO@JOValentino.com

Visit: JOValentino.com

Share: