Celebrity estate planning mistakes aren’t just headlines—they’re cautionary tales for all families. I understand this journey intimately, not just as an attorney, but as someone who suffered through a terrible probate when my grandfather passed away. It destroyed my family. I vowed to make the world a better place by learning the law and becoming a lawyer—helping families get the quality legal counsel they deserve. [Read my story here.]

Introduction

Val Kilmer, beloved star of “Top Gun” and “Batman Forever,” recently passed away. His story – from iconic movie roles to difficult health struggles – underlines how unforeseen circumstances can change everything, even for a Hollywood icon. Despite his fame, many of the legal questions about his estate could apply to everyday families as well.

In my Florida legal practice, I see people face critical estate issues all the time: How do you prevent drawn-out probate fights? Who inherits your home or business? Is your digital legacy protected? Kilmer’s passing provides a lens to examine these questions and learn key lessons for your own planning.

Why Val Kilmer’s Passing Reveals Common Celebrity Estate Planning Mistakes

Val Kilmer’s case reminds us that even the wealthy and well-known are not immune to celebrity estate planning mistakes. Despite public visibility, their families often deal with the same emotional and legal fallout due to poor or incomplete planning.

- If you do no planning, state law and courts step in.

- If you do partial planning, loved ones could still face disputes or long timelines.

- If you do comprehensive planning, your family benefits from clarity, privacy, and a quicker process.

- My Experience

Over the years, I’ve seen how estate planning can either bring families closer or tear them apart. It’s not just about drafting documents – it’s also about guiding people through difficult conversations and ensuring assets pass in ways that honor your wishes. Having navigated my own family’s probate nightmare, I’m particularly driven to shield others from that pain. My focus is on practical solutions that stand the test of time.

5 Estate Planning Lessons to Avoid Celebrity Estate Planning Mistakes

Lesson 1: Celebrity estate planning mistakes often begin with outdated or nonexistent wills.

- Wills are the foundational documents that lay out who gets what. If you pass without one, your estate goes through intestate probate according to Florida law, possibly triggering confusion or conflict.

- Trusts can bypass public probate entirely. A properly funded revocable living trust ensures privacy, a smooth transfer of assets, and often fewer legal expenses for your heirs.

- Florida Statute Reference: Florida Statutes Chapter 736 (Trusts)

Lesson 2: Incapacity Planning

- Durable Power of Attorney: Appoint someone you trust to handle financial matters if you’re incapacitated.

- Health Care Surrogate: Designate a person to make medical decisions on your behalf.

- Living Will: Specify how you’d like end-of-life care managed (e.g., life support preferences).

Kilmer’s health battle reminds us that anyone can face incapacity. These documents keep you in control by ensuring trusted individuals can act in your best interest.

Lesson 3: Many celebrity estate planning mistakes involve ignoring digital rights or online accounts.

In our digital age, important photos, financial accounts, and even creative content (like Kilmer’s likeness and voice) need formal instructions.

- Without proper directives, loved ones may be locked out of online accounts.

- Florida’s Fiduciary Access to Digital Assets Act can help if referenced correctly in your estate documents.

- Florida Statute Reference: Florida Fiduciary Access to Digital Assets Act (F.S. §§ 740.001-740.13)

Lesson 4: A leading cause of celebrity estate planning mistakes is failing to update key documents after major life events.

- Regular Updates: Life events (marriage, divorce, a new child) mean your documents need review.

- Communicate Your Wishes: Let key family members know your general plan. Surprises can breed resentment or legal fights.

Lesson 5: Considering Charitable Wishes

Like many celebrities, Kilmer was associated with philanthropic causes. If you have charities close to your heart, setting up legacy gifts in your will or trust can both support good causes and provide potential tax benefits for larger estates.

Example

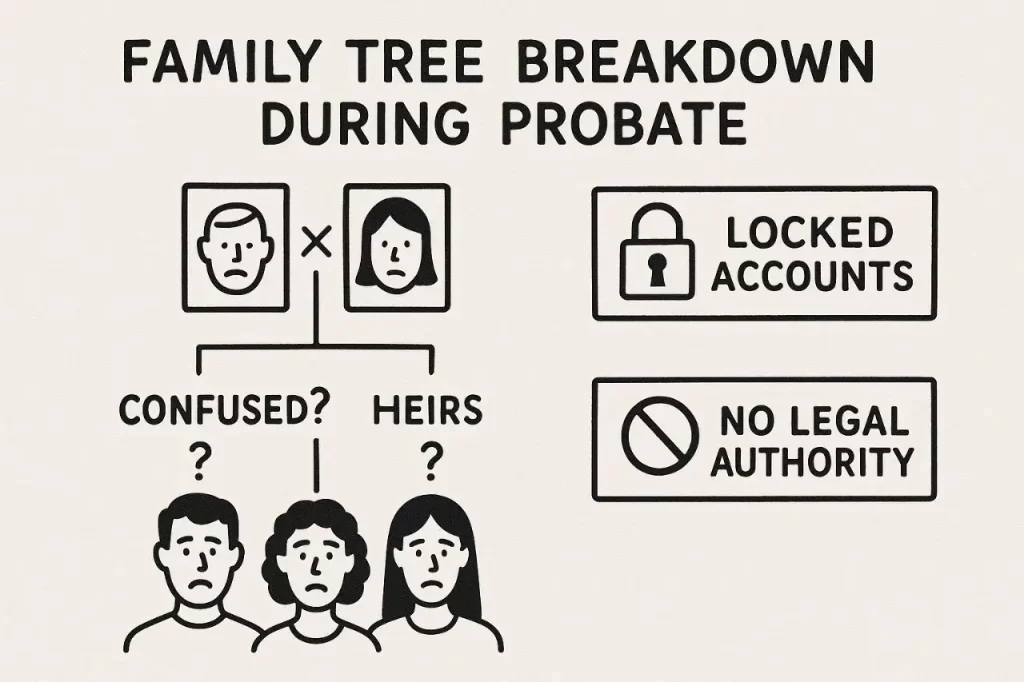

Imagine a Daughter caring for her aging father. He owns a modest home, has some digital assets (like an online collectibles store), and verbally mentioned leaving everything to his two children. But he never updated his estate plan after divorcing their mother:

- Daughter tries to arrange care when Father falls severely ill, but she lacks the authority to manage his finances.

- Son insists on selling the home immediately after Father’s passing, but the title is still in Father’s name with no will or trust designating a transfer.

- The online collectibles store is locked behind Father’s private credentials, which no one can access legally without digital asset directives.

Breakdown

- Probate Delays: With no up-to-date will, the children must go through probate.

- Financial Confusion: Without a power of attorney, Daughter cannot pay Father’s bills or manage his online ventures.

- Family Dispute: Son’s demands to sell are complicated by a lack of clear instructions in a will or trust.

- Digital Assets: Revenue from the online store is suspended because no one has the authority to access or manage it.

Had Father used a revocable trust and updated beneficiary designations post-divorce, the children would likely avoid these roadblocks.

Author’s Note

I’ve experienced firsthand the emotional toll of probate battles. Every phone call I receive from a distraught spouse or adult child dealing with an unexpected legal maze reminds me why I do this work. I find real joy in giving families clarity and peace. When you come to me, I’m not just your lawyer – I’m an ally who understands how deeply estate issues affect personal relationships. I’m here to safeguard both your assets and the harmony among those you love.

Disclaimer & Final Thoughts

This article is for informational purposes only and does not create an attorney-client relationship. The only way to create an attorney-client relationship with me is to receive a signed writing from me saying I am accepting to become your attorney.

Wealthy families and international investors need an attorney to provide strategic estate tax planning.

Families suffering expensive long-term care need an attorney to provide Medicaid crisis planning.

Beneficiaries who inherit a home and see their taxes jump up need an attorney to fight to lower their tax bill.

I write wills, trusts, powers of attorney, and health care surrogates.

If you need letters of administration, I represent you in probate.

Did you have a tough probate? I can appeal it.

You have three ways to get in touch with me.

- You can call me at (305)634-7790

- You can email me at JO@JOValentino.com

- You can fill out the contact form at www.JOValentino.com/contact

Share: