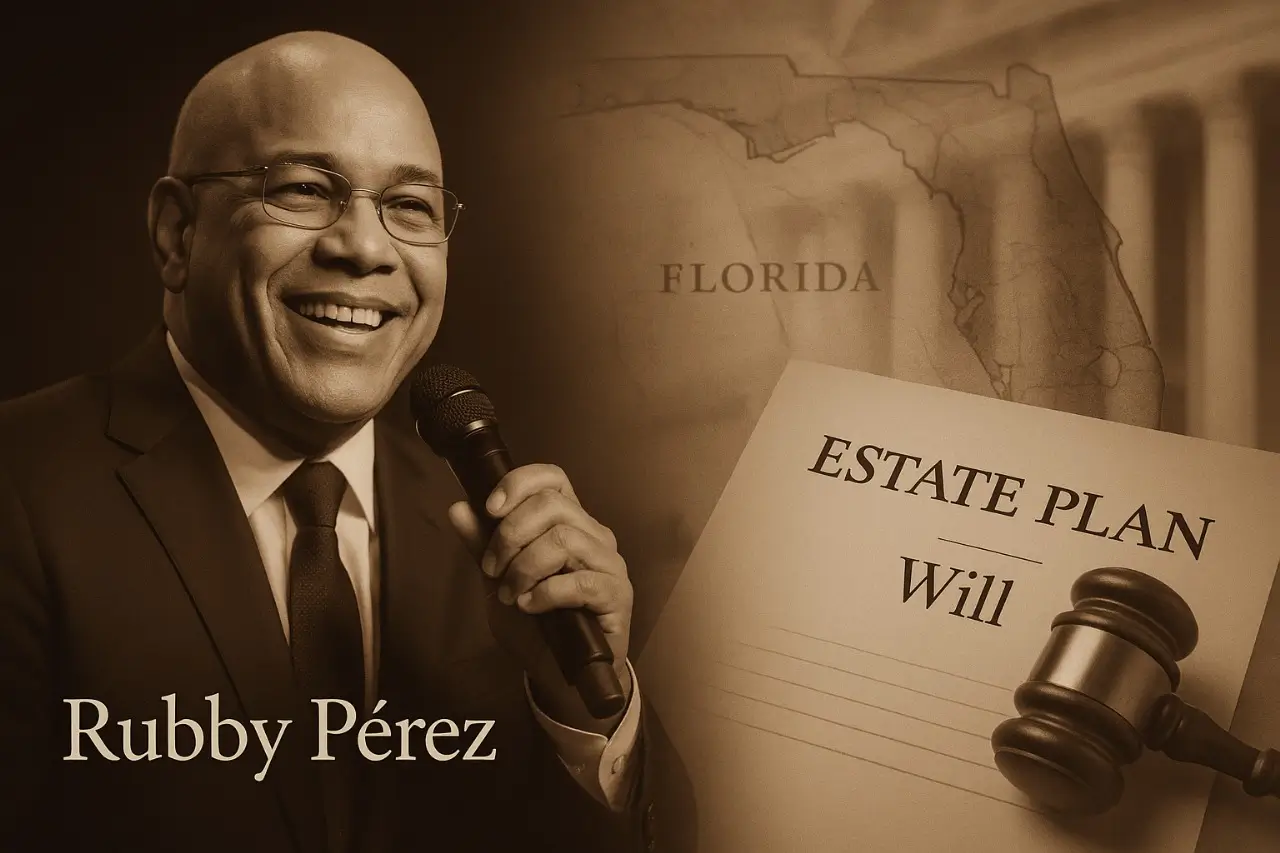

I understand this journey intimately—not just as an attorney, but as someone who lived through the pain of a complex probate after my grandfather passed away. It devastated my family and exposed how unprepared we were. That experience shaped my purpose: to help others avoid the same heartbreak. Today, I focus on providing compassionate, strategic estate planning for blended families in Florida, ensuring that spouses, stepchildren, and minor heirs are protected when the unexpected happens.

Read my full story at www.JOValentino.com/about.

Why Estate Planning for Blended Families in Florida matters

I want to dive deeply into one of the most heartbreaking scenarios I’ve encountered: the shocking collapse of the Jet Set Nightclub that claimed the life of MLB World Series Champion Octavio Dotel. Not only was Octavio’s passing devastating to his family, friends, and fans, but it also brought significant legal and financial implications. Adding to the sadness is the earlier murder of Octavio’s father, which also sets the stage for key lessons on how inheritance can be handled when someone is murdered.

When large estates and sudden tragedies intersect, it highlights the complexities of estate planning and probate administration. My goal here is to share insights on how to best protect families when the unexpected happens, especially for those living in or owning assets in Florida. I want you to feel empowered to take steps now to safeguard your loved ones and honor your family’s legacy.

Helping Florida Families Avoid Probate Disasters

Over the years, I’ve had the privilege of guiding clients through everything from basic will drafting to complex cross-border estate planning. In my practice, I prioritize clarity, compassion, and client education. I believe in translating the legalese so that you fully understand what’s happening with your affairs. When I handle estate matters—whether that’s drafting wills or trusts, dealing with probate, or navigating tricky inheritance disputes—I hold my clients’ best interests at heart. Ultimately, my greatest measure of success is seeing families find peace of mind and unity rather than discord.

Background: The Tragic Loss of Octavio Dotel & His Father

Octavio Dotel was a recognized MLB pitcher and World Series Champion who found success on the mound. However, he tragically lost his life when the Jet Set Nightclub suffered a catastrophic structural failure. This untimely death was preceded by another devastating event: the murder of his father soon after Octavio signed his MLB contract.

These incidents raise important issues:

- How do loved ones handle estate matters when death is abrupt and unexpected?

- What happens if someone is murdered, and what inheritance rules apply (especially if the perpetrator is a potential heir)?

When we break down these scenarios, we see that the complexities stretch far beyond grief. They touch on probate laws, Florida’s Slayer Statute, asset protection, and more.

Five Florida Estate Planning Tips for Blended Families

1. Sudden Death & The Importance of Updated Documents

No one anticipates a nightclub collapse or a fatal accident, but these things do happen. If someone passes away without:

- A valid will or trust

- Updated beneficiary designations

- Powers of attorney and healthcare directives

…their loved ones can be left scrambling. In Florida, probate can be time-consuming and expensive. To better understand the legal process, see this overview of the Florida probate process.Meanwhile, families may face immediate financial burdens. Having an updated estate plan reduces court intervention and ensures your assets go to the right people quickly.

2. Cross-Border and Multi-State Considerations

Octavio Dotel had ties in multiple jurisdictions (his home country, the U.S., and elsewhere). When estates include property or assets across borders:

- Ancillary probate could be required in each locale.

- Different inheritance laws can create confusion.

- Complexities increase without legal structures like trusts or designated beneficiaries.

An attorney familiar with multi-jurisdictional estate law helps streamline the process, ensuring beneficiaries don’t get entangled in conflicting rules across states or countries.

3. Inheritance Concerns After a Murder: Florida’s Slayer Statute

When someone is murdered, the estate automatically faces two major challenges:

- Emotional Turmoil for the family

- Legal Complexities involving the killer and the estate

Florida’s Slayer Statute (Fla. Stat. §732.802) ensures that if an heir or beneficiary intentionally kills the decedent, that individual cannot profit from the crime. Even if there is no criminal conviction, a civil court can disqualify the murderer from inheriting, treating them as though they predeceased the victim. This prevents any possibility of someone “murdering their way” into an inheritance.

4. Protecting Your Loved Ones With Trusts & Guardianship

For individuals with significant assets or minor children, trusts and guardianship designations are critical:

- Trusts avoid probate and keep distribution private. They can also protect wealth from creditors and estate taxes if structured correctly.

- Guardianship designations for minor children in a will let you name someone you trust to care for them if both parents pass away. Without this, a court decides who takes custody, and the process can be grueling. Learn more about guardianship of minors in estate planning from the American Bar Association.

5. Communication and Regular Reviews

I often say “your estate plan is a living document.” It changes as life changes:

- Marriages, divorces, births, and deaths should trigger an immediate review.

- Update beneficiary designations on insurance, retirement accounts, or investment portfolios.

- Make sure that everyone involved—your spouse, adult children, or trusted advisors—knows you have a plan and where to find critical documents.

Example Case: Probate Chaos from an Outdated Will

Let’s imagine a scenario akin to what happened with Octavio’s family.

- Mother is raising three children. She marries a successful business owner who becomes a stepfather to the kids. He sets up a will early on, but never updates it once his business expands. Tragically, he passes away in a sudden accident (structural collapse) while traveling abroad.

- Daughter later discovers that the stepfather owned property in Florida, a foreign property, and a significant life insurance policy. But the will references none of this, since it was created before he amassed such assets. The courts now have to sort out how to handle these properties, and the intestacy rules in Florida may come into play for assets not covered by the old will.

- To compound the pain, the mother is forced to open a probate case in Florida and another in the foreign jurisdiction. Delays, legal fees, and stress pile up—all while the family is grieving and needs funds to maintain their lifestyle.

How to Prevent Estate Disputes and Probate Delays in Florida

In the above scenario, if the stepfather’s will had been updated to include all assets and design proper beneficiaries, the family could have avoided or minimized:

- Multiple probate procedures across jurisdictions.

- Inadvertent disinheritance of children or a spouse.

- Delayed access to critical funds for everyday living expenses.

For someone who’s juggling a successful business, foreign assets, or a high-net-worth lifestyle, relying on an outdated will is a recipe for confusion. Beneficiary designations on life insurance and retirement accounts are also essential to keep current. Finally, if the stepfather had tragically been murdered, Florida law would prevent any wrongdoing heir from inheriting under the Slayer Statute, preserving the assets for legitimate heirs.

Why I Advocate for Family-Centered Estate Planning

I’ve personally walked through the devastation of a drawn-out probate, which tore my extended family apart. Through that experience, I realized how a well-thought-out estate plan can be the difference between a relatively smooth transition and a legal nightmare. I became an attorney to guide families like yours through planning that protects both relationships and finances. I understand that this isn’t just about paper and signatures; it’s about the love and security you provide to the people who matter most—during your lifetime and beyond.

Take Control: Protect Your Blended Family with a Plan

Octavio Dotel’s untimely passing in the Jet Set Nightclub Collapse, coupled with his father’s earlier murder, underscore just how unpredictable life can be. Estate planning is a shield that helps protect you and your family from additional heartbreak when tragedy strikes. If there’s anything I’ve learned, it’s that an effective plan involves:

- Up-to-date wills or trusts

- Clear beneficiary designations

- Guardianship planning for minor children

- Cross-border or multi-state strategy if you hold assets in different places

- Knowledge of key laws like Florida’s Slayer Statute

You have three ways to get in touch with me.

- You can call me at (305)634-7790

- You can email me at JO@JOValentino.com

- You can fill out the contact form at www.JOValentino.com/contact

Disclaimer: This Article Is Not Legal Advice

This article is for informational purposes only and does not create an attorney-client relationship. The only way to create an attorney-client relationship with me is to receive a signed writing from me saying I am accepting to become your attorney.

Wealthy families and international investors need an attorney to provide strategic estate tax planning.

Families suffering expensive long-term-care need an attorney to provide Medicaid crisis planning.

Beneficiaries who inherit a home and see their taxes jump up need an attorney to fight to lower their tax bill.

I write wills, trusts, powers of attorney, and health care surrogates.

If you need letters of administration, I represent you in probate.

Did you have a tough probate? I can appeal it.

FAQs

Why is estate planning important for blended families in Florida?

Without a plan, stepchildren or new spouses could be unintentionally disinherited under Florida’s intestacy laws.

What is Florida’s Slayer Statute?

It prevents anyone who intentionally kills a family member from inheriting, even without a criminal conviction.

How does guardianship work for minor heirs in Florida?

If parents pass away without naming a guardian, the court appoints one. This can lead to delays and family disputes.

Should estate plans be updated after remarriage?

Absolutely. Marriages, divorces, births, or major asset changes should trigger immediate estate plan reviews.

Share: