Here is my seven-step guide to the Quick Florida inheritance process. I’ve helped hundreds of families with their inheritances. Let me explain the steps to you the same way I explain them to a new member of my team who is getting trained in summary administration. I think you’ll find my seven-step guide very real and practical.

Introduction to Quick Summary Administration

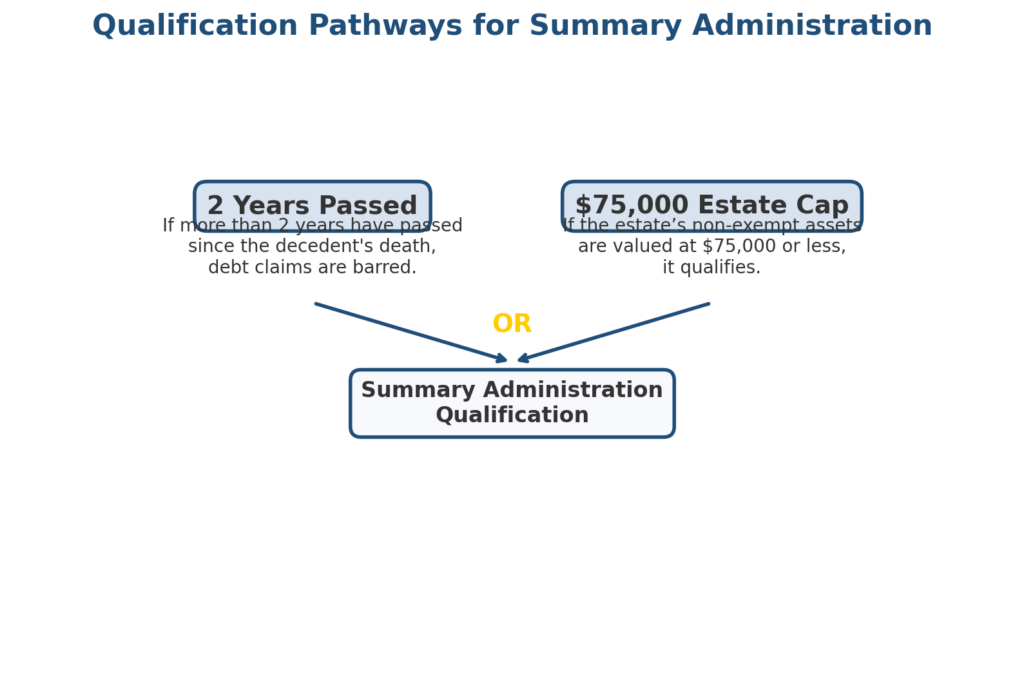

Before we dive into the seven steps, let’s first determine whether you qualify for what’s called a quick summary administration. To qualify, you’re in if it’s been two years or more since the decedent passed away. If it’s been less than two years, that’s OK. In that case, you’ll need to consider whether the inheritance is $75,000 or less. If it is, you’re in—you qualify.

When I was first starting out, I wondered if people inheriting houses would qualify, even if the house was worth more than $75,000. It turns out they do. You can inherit a house even if it’s been less than two years since the decedent passed away, if that house was the decedent’s home (primary residence). When you see the word “homestead,” that’s what I’m referring to.

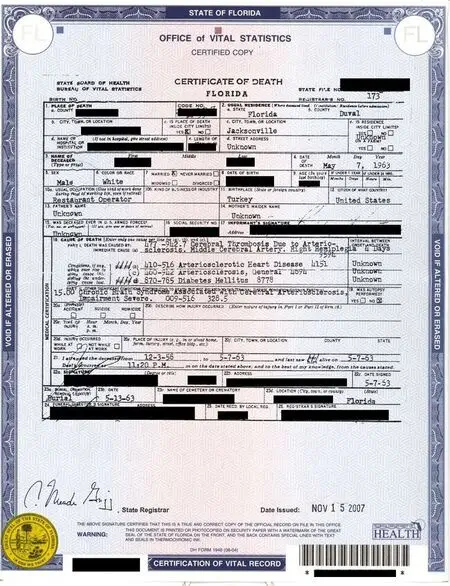

Step 1: Obtain the Decedent’s Death Certificate

The first step is to obtain the decedent’s death certificate. You likely received the blue document from the funeral home. I always fold it up and stick it in an envelope, but make sure to include a cover letter so it doesn’t get lost in the mail. The judge needs to touch the death certificate. It must be an original death certificate. If our client doesn’t have a death certificate to give the judge, we buy one from the Florida Department of Vital Statistics. When there’s a major time crunch, I go in person to the office and fill out a form with the clerk and walk out with a death certificate in my hand. Thankfully, my team and I are really good at avoid time crunches from our hundreds of reps of experience. The best practice, in my opinion, is to just order a death certificate from Vital Check, which is a company that is authorized by vital statistics to provide death certificates. Vital Check then mails it to me. The death certificate is submitted after the case is opened and the clerk of court has a assigned a case number. So the timing with Vital Check is perfect.

This office handles probates from people who lived all over the world. If the death certificate is in Spanish, (or any other language) it must be translated to English by a certified translator and apostilled. Apostille is a process where a foreign death certificate is authenticated as the real deal by rules established by an international agreement called the 1961 Hague Convention Treaty.

Step 2: Prepare the Petition for Summary Administration

Next, you need to prepare the petition for summary administration. This document includes all the critical details of the inheritance. Start with your name as the petitioner and beneficiary, list the decedent’s name, the date they passed away, and a statement that they resided in the county where the inheritance is taking place. You’ll also list the names and addresses of each beneficiary, and finally, the assets everyone’s going to inherit. For example, list the bank name, the last four digits of the account number (e.g., #1234), and the dollar amount in the account.

Step 3: Provide the Paid Funeral Bill

Now, step three is to provide the paid funeral bill. There’s a right way and a wrong way to do this. In my experience, getting it wrong can delay the whole case. I have three steps, A, B, and C, to get the funeral bill.

I want to tell you about a time when I skipped providing a paid funeral bill, and things didn’t go well. I ended up receiving a rejection letter. It was rough because I had the law on my side, after all, it had been over two years since the decedent passed away. The two year limit on credit claims on estates had run. There was no way that a funeral home could bring a claim at this point. So, I made it clear that it had been over two years and I didn’t spend any effort getting my hands on a funeral bill that was not legally relevant. I was trying to save my client’s time. Big mistake—I received a rejection letter, and I was so surprised. Since then, my team and I always provide the paid funeral bill unless we have a good reason not to.

Step A: Obtain the Funeral Home’s Contact Information

Step A for me and my team is to obtain the contact information of the funeral home. To do this, we first check the death certificate. About three-quarters of the way down, there’s a section titled “Funeral Facility.” There, you’ll find the funeral home name.

We take that name, enter it online, and give them a call. I typically say, “Hello, this is J. O.,” and then ask, “Who is the best person to send an email to today?”

Step B: Send an Email and Cover Letter

Step B is to put together an email and cover letter. I always include a cover letter because it helps keep our files organized—emails tend to get lost or buried over time. Another benefit of the cover letter is that it has my law firm’s letterhead on it. When funeral homes see my letterhead, it often gets things moving a bit faster in my experience. I send an email and cover letter stating, “This is Attorney Jesus Orlando Valentino. I are reaching out to you regarding the service you provided to decedent John Doe. Please provide a letter on your letterhead stating zero balance due.”

Step C: Review the Letter from the Funeral Home

Step C is for our team is to review the letter we receive from the funeral home. We make sure it includes the funeral home’s letterhead, the decedent’s name, and the key phrase: “zero balance due.” If any of these elements are missing, we give the funeral home a call and ask them to make a quick correction

Quick Florida Inheritance Mistake: Using a Receipt

There’s another way to provide proof the funeral bill was paid—a receipt from the funeral home. In my experience, it’s hit or miss. The funeral home receipt is often just an invoice that says how much the services cost. The problem is these receipts have a bunch of information packed into one page full of tiny numbers that are super hard to read. Worse yet, many receipts are put on carbon copy paper. That paper has very faint ink on it that does not convert well into a to a digital format when scanned. The receipt might have a signature from the person who paid, but it often doesn’t say “zero balance due.” Some receipts are better than others though. The best receipts have a big red stamp that says “Paid in Full.”

Those work pretty well.

Our Favorite Practice: Get a Letter

Even if we have a great receipt with the paid in full stamp, I prefer to still get the letter saying “zero balance due.”

What to do in a Tough Spot

If we can’t get a hold of the funeral home for some reason and all we have is the receipt that doesn’t state “zero balance due,” we ask for a screenshot from the banking app showing the payment to the funeral home. We then compare the amount on the receipt with the amount shown on the bank statement and submit both documents together.

Avoiding Rejections:

Situations with more complicated or convoluted documents result in higher rejection rates, which slow down the inheritance process. In short, if it’s hard to read, the court is more likely to reject it. I try to avoid rejections whenever possible. That’s why I like easy to read letters on funeral home letterhead that say “zero balance due.” Want to see a video I made about the paid funeral bill requirement?

Want to see a video I made about the paid funeral bill requirement?

Step 4: Create the Affidavit of Heirs

Step four is to create the affidavit of heirs. This document shows the family tree, listing the connections between the decedent and each beneficiary. Be sure not to overlook any half-blood or step relationships when putting this together. This is the type of omission can get someone thrown in jail.

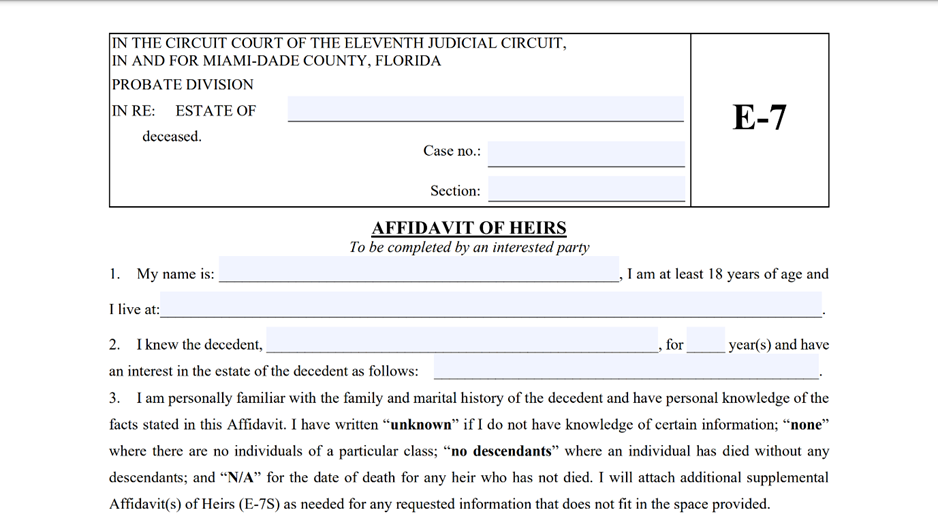

Step A: Fill Out Paragraphs 1-3

Step A is to get our eyes on paragraphs 1, 2, and 3.

In paragraph one, you’ll list the affiant’s information (usually the client).

In paragraph two, I put the decedent’s name in the first box. In the next one I put the number of years the affiant knew the decedent. Last, I’ll list the affiant’s relationship to the decedent (e.g., surviving spouse, daughter, etc.).

In paragraph three, we don’t have to fill anything out. The third paragraph invites the affiant to use of the word “unknown” if you don’t know something like someone’s address, or “none” if a section doesn’t apply (e.g., if the decedent had no children, you would write “none” in the box for children). This will be useful for the next step.

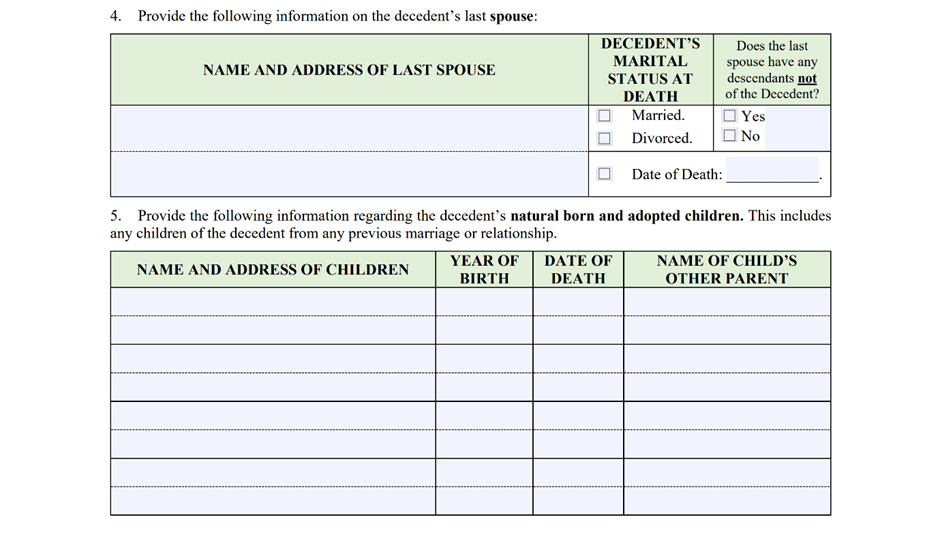

Step B: Fill Out Paragraph 4: Last Spouse

Step B is filling out paragraph four, which is all about the “last spouse.” The last spouse is the most recent person the decedent was married to, whether they were married at the time of death or previously divorced. You’ll include the last spouse’s name and address. The name goes in the top box and the address goes in the bottom box. Then check the appropriate box for the decedent’s marital status (married or divorced). If the decedent was single or widowed, then leave those boxes blank.

There’s also a checkbox to indicate whether the last spouse had children outside of their marriage to the decedent. If the last spouse had children with anyone other than the decedent, then mark “yes.” If the last spouse has passed away, there’s a place to list their date of death as well.

Step C: List All the Children

Step C is to fill out the information for all the decedent’s children on paragraph 5. Don’t forget anyone—it’s fraud if you intentionally leave someone out, and you can go to jail. I always tell my team to be thorough and stick to the truth. I have seen the judge get upset when they find our someone was intentionally left off the affidavit of heirs (not MY client of course). I was the attorney who brought it to the judge’s attention. The judge then had me write a court order that included jailtime. If you are being left out of an inheritance illegally, get in touch with me ASAP.

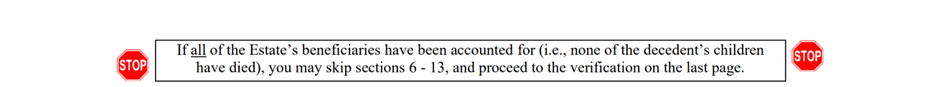

Step D: Perform the Stop Sign Analysis

Step D for me is to perform the Stop Sign Analysis. This form features a couple of stop signs, with instructions telling us when to proceed and when to stop. I read what I have filled out so far and ask myself, “have all the beneficiaries been included?” If you are not sure who the beneficiaries are, call me and we’ll find out for you.

If all the beneficiaries are accounted for, we skip ahead to the notarization. However, if there’s even one beneficiary who hasn’t been listed, we continue filling out the rest of the form. This usually happens in two situations:

- The decedent was never married and had no children.

One of the decedent’s adult children passed away, leaving behind their own children (the decedent’s grandchildren). In these cases, we fill out paragraphs 6 through 13.

Step E: Notarize the Affidavit of Heirs

Step E is to notarize the Affidavit of Heirs. You can use an online notary, which is faster and more convenient. If you prefer the old-fashioned method of going in person, triple-check the document to avoid any mistakes that could lead to a rejection letter. You might have guessed it by now, but I have made a full video on this topic. It’s not up yet. But subscribe to my YouTube channel JO Valentino and you’ll get to see it when I post it.

Step 5: Petition to Determine Homestead

Now you can inherit the decedent’s home through a quick summary administration. Step five is going to help get us there. In step 5, I prepare the petition to determine homestead. This document enables you to inherit the decedent’s home. It lists the decedent’s name, date of passing, residence county, and the address and legal description of the property. I’ll also list the names of the beneficiaries who are inheriting the property.

This petition is super important, so I broke it down for you.

Step 5A : Petition to Determine Homestead

Step 5A is for me to put together the petition to determine Homestead. Homestead means the home that the decedent lived in. The purpose of the petition to determine homestead is to show that the house that the decedent owned was the decedent’s home.

One of the key items in the petition to determine homestead is your name and the decedent’s name. Paragraph 2 is the address of the property and the legal description of the property.

I obtain the legal description of the property by looking at the deed. Here’s how I get the deed. On Google, search for your county’s property search page. A good result will often say Property Appraiser. In, the future, I hope to create a database of these links on JOValentino.com so that you can feel more confident and don’t get lost looking on some fake website that makes you pay for the info when you can get it free if you know what you’re doing most times. Select your inheritance county and then select the Property Search link.

In the Property Search, you’ll enter the address of the property or the property owner’s name and then you’ll look for the deed.

In the deed, you’ll go to what’s probably the 4th paragraph and you’ll see something that says the words “lot” and “block” and “recorded in the official records of the county….”

That’s a good sign you’re looking at the legal description. You might have guessed it by now, but I have made a full video on this topic. It’s not up yet. But subscribe to my YouTube channel JO Valentino and you’ll get to see it when I post it.

Paragraph 3 has the names of the beneficiaries.

Paragraph 4 says that the house was the decedent’s home and homestead.

Paragraph 5 lists the names of anyone else involved with the case. And the last paragraph on the petition states that you are requesting that the court enter an order stating that the house was a homestead.

Step 5B: Affidavit in Support

And that brings us to step 5B, which is the affidavit in support. It’s also known as the third-party affidavit. This document is required in some counties but not all. It can be quite frustrating. Some Florida counties can skip this step.

The affidavit of support is a notarized letter, but it’s not notarized by you—though you find someone to get it done for you. The best choice is a neighbor because the neighbor’s affidavit stands up really well in court. The neighbor has no link to the inheritance, so they have no reason to lie. Try to avoid picking a neighbor if the neighbor has the same last name as the decedent. I’ve received rejection letter once when a neighbor had the same last name as the family. It was a common last name. I tried to explain the circumstance to the court with an additional letter, but the court made me go get another one.

If you don’t have a neighbor, then what you could do, and I’ve seen this with a lot of success in my experience, is find a friend of the decedent. Maybe the decedent’s best friend is looking to help you out. If you can’t get a friend and/or a neighbor, then maybe you can look to a cousin—and again, try to pick a cousin who doesn’t have the same last name as you. You don’t want to get held up.

Now, when it comes to getting the affidavit in support signed, you can be tech-savvy. You can use an online notary. The good thing about this is then nobody has to leave home. If you’re not tech-savvy, that’s OK. What I’ve seen work with great success is that you go and pick that signer up and you take them to a notary.

The affidavit in support will include the signer’s name and the signer’s identification number. So, if you’re using an ID or a driver’s license, make sure you put the full driver’s license number there. I’ve received the rejection letter in the past if it just had “Florida ID.” That’s not good enough. This is not a place where you want to skip out on the details. Otherwise, the court is going to make you do it again.

The affidavit of support will also state how many years the signer knew the decedent and how many years the signer knew that the decedent lived in the house. The document will also state who the signer believes are the beneficiaries of the estate. Then it’s going to have a notarization paragraph at the bottom for the notary to sign.

If you are signing this with a notary in person and you see your notary get distracted, make sure to double-check that notarization paragraph. Make sure every box is checked. One common thing that could be missed is the date of the notary or how the notary verified the identification of the signer (by checking the ID or personally known). You want to make sure that you don’t leave the notary and have an incomplete document. You want to make sure it’s all there. So, check it while you’re in front of the notary. That’s what I ask my people to do, and it’s worked to great effect.

Step 5C: Provide a Utility Bill or Tax Bill

Now, step 5C is to provide a utility bill or tax bill. Not every county requires this. I hope to make a database on my website with this info to save you time. In the meantime, call me and I can make sure you don’t get held up for not having it when you need it. If you have to do this step, then what you’ll do is search for your county’s tax collector.

The tax collector website has a search function where you enter the address of the property, and then you’ll see all the tax history for the property. With that tax history, you click the most recent one, and it’ll pull up and download that PDF. You’ll know it’s good because it’ll have the decedent’s name on it and the address of the property. Whether the bill has been paid or not is not what matters. Don’t get hung up on that now. What matters is that the decedent’s name is on the tax bill because the point of this document is to show the court that the decedent owned this property.

Step 6: Draft the Proposed Order Determining Homestead

Finally, step seven is to draft the proposed order determining homestead. This is the document that allows you to inherit the house in a quick summary administration. It includes the decedent’s name, the date they passed away, a statement that they resided in the county, the property address and legal description, and the names of the beneficiaries who will inherit the property.

Proposed Order Determining Homestead

In steps 6 and 7, I will be putting together the proposed orders that the judge will sign. In step 6, I’ll be putting together the proposed order determining homestead. This is the paper that will show that you have inherited the decedent’s home. In this document, it’ll have your name, the date the decedent passed away, the address, and the legal description of the property.

I have to put the legal description of the property in the proposed order determining homestead. I always remind my team to do their best to not to make any boo-boos when writing the legal description. It can be long and technically demanding to get every detail right. I have done some legal descriptions that were of rural land that is measured by distances instead of lots and those legal descriptions are surprising long and tedious to copy down.

And then I’ll also add on that order the names of the beneficiaries and a statement that now that home is protected from the claims of creditors. Now, there are limitations to the creditor protection. Don’t go out there doing wild stuff. Don’t try and skip out on paying your tax bill, OK? Don’t go out and skip paying your roofer, OK? It’s probably not going to go well for you.

Step 7: Prepare the Proposed Order of Summary Administration

Next, you’ll need to draft the proposed order of summary administration. This document includes the decedent’s name, date of death, age, county of residence, and the location of their passing. It also lists each beneficiary and the assets they will receive.

Proposed Order of Summary Administration

Step 7 is where I write the order of summary administration. In this proposed order I will put my client’s name, the decedent’s name, the date that the decedent passed away, the names and addresses of all the beneficiaries, as well as the assets that each beneficiary is going to receive.

If you are inheriting a homestead (some people just inherit money), I always tell my team to not include the homestead property in the order of summary administration. This is something I did before once, and I got a rejection letter, so we never want to do that again. The bank account that you’re inheriting does go in the order of summary administration. I make sure to list the money you are inheriting in this proposed order. Just to be super clear, the homestead property does not go in the order of summary administration. Got it?

Sometimes the inheritance is only about the home. There is no bank account. It’s just the home. There’s nothing else to inherit. My team has asked me before, “Hey, Jo, does that mean that we can skip the order of summary administration?” The answer is no. I do not skip the order of summary administration.

That’s because the petition for summary administration is more than just a petition for people inheriting bank accounts. I remind my team that the petition for summary administration also serves the role of being the petition that opens up the whole case. The order of summary administration also serves the role of being the order closes the whole case.

I am still going to do an order of summary administration. I do it like this, I add in what I call a concurrent sentence (AKA magic lawyer language) to increase the chance everything gets approved. I then submit the proposed order determining homestead and at the same time I submit the proposed order of summary administration.

And in that proposed order of summary administration, we include some language that says there are no assets remaining in the estate besides the home that is being distributed via the concurrent court order determining homestead.

Conclusion:

And that’s it! That’s my insider’s step by step guide to a summary administration in Florida. That’s a quick guide on how you can complete a quick Florida inheritance from home.

The Youtube video with the above information is available here:

Need help with your inheritance? Contact me today:

📞 Phone: (305) 634-7790

📧 Email: jo@jovalentino.com

🌐 Contact Form

Disclaimer

This article is for informational purposes only and does not constitute legal advice or create an attorney-client relationship. Reading this does not make me your lawyer – I can only accept that role through a signed written agreement with you, after we’ve both agreed to it. Every situation is unique, and laws change. Please consult me (or another qualified attorney) for advice tailored to your specific circumstances. Until you receive a signed writing from me confirming I’ve agreed to be your attorney, please do not assume any guidance here applies to your exact situation. I am licensed in Florida, and any references to laws are based on the current statutes and rules as of the time of writing. I strive for accuracy, but I cannot guarantee that all information here remains up-to-date or applicable to all readers. In short: Let’s talk one-on-one before making big decisions. I’m here when you’re ready.

Thank you for reading, and I wish you and your family the very best in wealth, health, and happiness.

Share: