Tax exemption on foreign income is no longer limited to offshore havens. The proposed “Trump Card” Gold Green Card—backed by Donald Trump and financier Howard Lutnick—offers U.S. permanent residency while exempting non-U.S. income from IRS taxation. For celebrities like Shakira, this could mean major tax relief. Unlike traditional green cards, it shields offshore earnings like royalties and investments. But is the $5 million price tag worth it? We explore the legal structure, celebrity examples, and estate-planning benefits of this unprecedented visa.

I understand this journey intimately – not just as an attorney, but as someone who suffered terrible consequences when my grandfather passed away. It destroyed my family. I vowed to make the world a better place by learning the law and becoming a lawyer and helping families get quality legal counsel.

Read my story here

How Shakira Could Benefit from Tax Exemption on Foreign Income

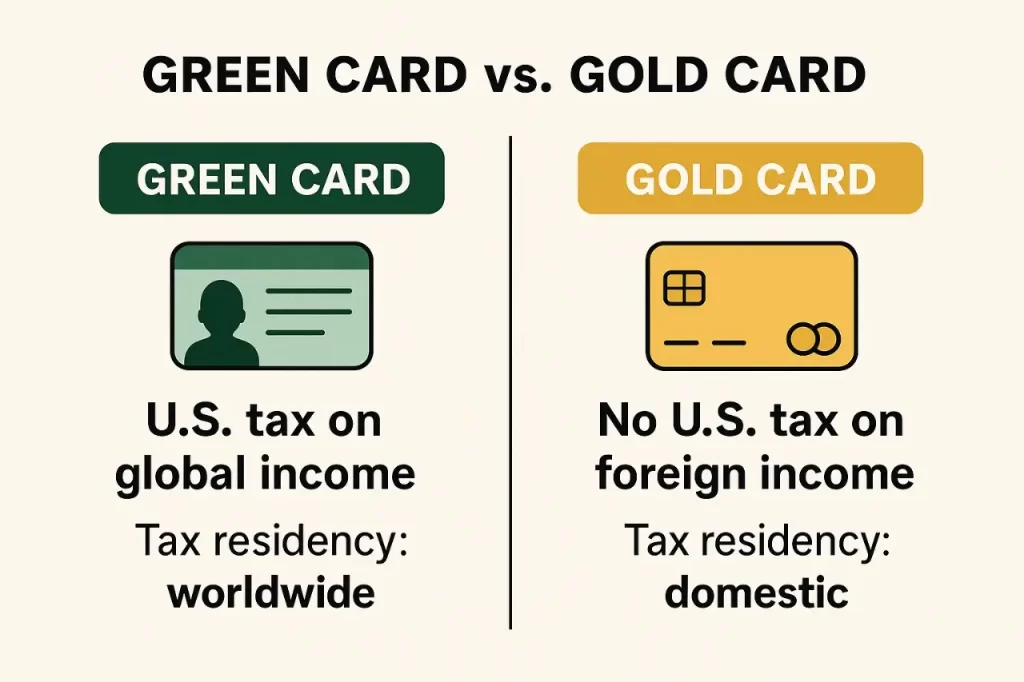

We’ve all read the headlines about a brand-new, high-profile immigration pathway dubbed the Gold Card “Trump Card” Green Card. According to various public statements by President Trump and financier Howard Lutnick, this unique visa offers U.S. permanent residency without requiring the holder to pay U.S. taxes on non-U.S. income. It’s nothing short of revolutionary, since traditional green card holders and U.S. citizens are generally taxed on worldwide income.

In the high-earning celebrity world, this raises some tantalizing questions: Is it worth switching to the new Gold Card if you already have a standard green card? Will it allow you to shield foreign income—royalties, endorsements, global tours—from Uncle Sam’s reach? If you’ve ever heard about the Spanish tax issues faced by stars like Shakira, you know how important it is to get your tax and residency decisions right.

In this article, I’ll compare the new Gold Card “Trump Card” to the classic green card, reveal what kinds of estate planning and tax advantages might be available, and examine whether someone in Shakira’s position would benefit from upgrading. I’ll also weave in insights from my own legal practice, focusing on the key steps to protect you, your family, and your legacy—without risking a tax fiasco or probate nightmare.

Helping High-Earning Clients Like Shakira Protect Their Legacy

I’ve devoted my career to estate planning, tax strategies, and elder law because I believe every family deserves clarity and protection. Sometimes, the law appears to favor big names and wealthy individuals—but the truth is, anyone can benefit from solid legal planning. Whether you’re an international star or a Florida retiree concerned about your children inheriting a home with a higher property tax bill, the principles of good counsel and strategic planning are the same:

- Anticipate problems before they surface.

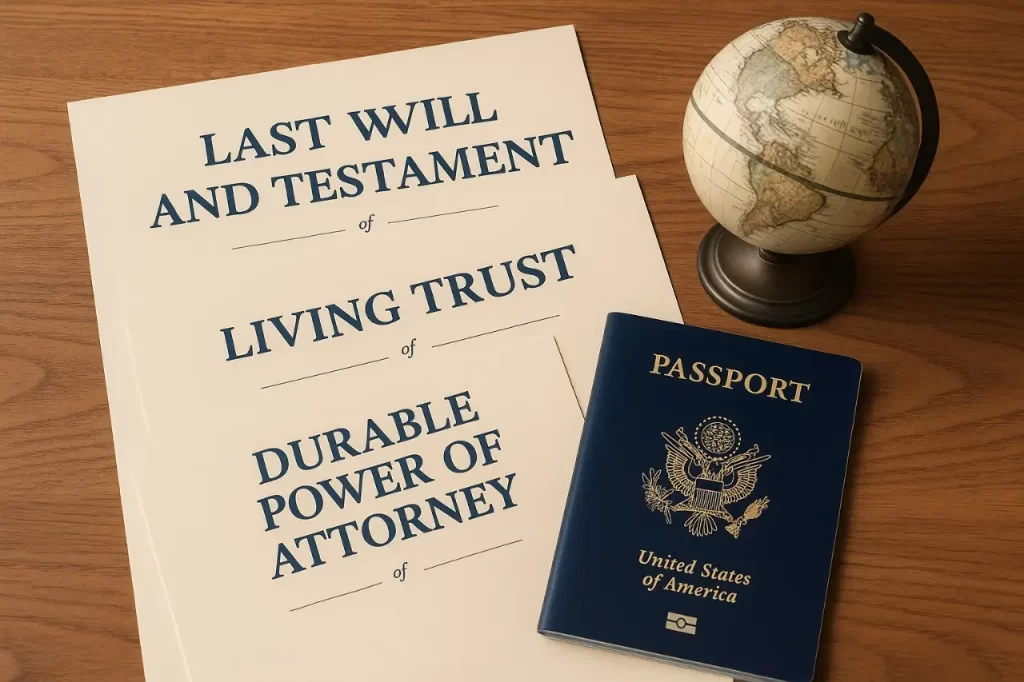

- Use legal tools (like trusts, wills, and powers of attorney) to protect your interests.

- Seek advice from an attorney who truly cares.

I’ve seen families torn apart by legal disputes. My own family experienced tragedy and conflict over a will, and it shaped my entire path. That’s why I take these issues so personally—and why I strive to give my clients the best possible solutions, no matter how complex.

Gold Card vs. Green Card: A Celebrity Tax Case Study

1. Standard Green Card Basics

- Worldwide Income Taxation: If you have a standard green card, the U.S. taxes your entire global income—royalties, business profits, wages, you name it.

- Path to Citizenship: After about five years, standard green card holders typically become eligible to apply for U.S. citizenship.

- Estate & Gift Taxes: Once you’re a U.S. resident, your estate may be subject to U.S. estate taxes on worldwide assets, depending on your domicile and how long you hold the green card.

2. The New Gold Card “Trump Card”

- No U.S. Tax on Foreign Income: According to Howard Lutnick and President Trump, this brand-new immigration status will exempt holders from paying U.S. taxes on foreign-sourced income. You’d still pay tax on U.S.-sourced income (e.g., royalties from a U.S.-based record label), but your overseas earnings are out of the IRS’s reach.

- Hefty Price Tag: Reports indicate this Gold Card may cost around $5 million, but no detailed statutory language is public yet.

- Immigration Benefits: You can live, work, and travel to and from the U.S. without the usual constraints standard green card holders face. Potentially, it also offers a route to eventual citizenship—but if you become a citizen, you’d lose the foreign-income tax exemption.

- Estate Planning Perks: By removing U.S. tax on non-U.S. income, you could grow foreign assets tax-free under U.S. law. However, your U.S. assets and estate might still be subject to estate taxes if you’re considered domiciled here.

3. Will Shakira Regret Her Old Green Card?

Pop icon Shakira has famously run into tax troubles in Spain, not the U.S. Spanish authorities alleged she owed millions in back taxes, primarily because they believed she spent enough days in Spain to be considered a tax resident there. From a U.S. standpoint, a standard green card means the IRS can look at her worldwide earnings. If she generated tens of millions overseas, the U.S. might impose a significant tax.

- Under the Gold Card: She’d owe zero U.S. tax on her global tours or foreign endorsements. Only her American ventures (like appearances on U.S. TV shows) would be taxed.

- Potential Tax Savings: Depending on how much of her income is from non-U.S. sources, she could realistically save tens of millions over her career by switching—assuming this new system remains in place and legally unchallenged.

4. Can Current Green Card Holders Upgrade?

The administration’s public statements suggest you can pay the required fee to upgrade from a standard green card to the new Gold Card. Whether celebrities like Shakira will do it likely boils down to a simple cost-benefit analysis: Is the one-time payment worth the ongoing reduction in worldwide tax? For many high-earners, the math speaks for itself: pay $5 million once, save many times that in potential U.S. tax over the years.

Example: International Celebrity with Worldwide Income

Let’s imagine a scenario involving a Mother who is a famous recording artist:

- She has a standard green card and spends half the year in Miami, half the year abroad.

- Her global record sales and worldwide concert tours bring in approximately $30 million each year—80% from non-U.S. sources.

- Under her current status, that $24 million (80% of $30 million) in foreign income is also taxable in the U.S.

- She learns about the new Gold Card and considers switching.

Potential Results:

- If she upgrades, she’ll owe no U.S. tax on the $24 million foreign income. She’ll only be taxed on the $6 million she makes in the U.S.

- Even if the one-time fee is $5 million, she might recoup those costs in just a couple of years through tax savings.

- Estate planning could become more flexible since she may keep substantial foreign assets growing offshore, shielded from U.S. income tax.

Breakdown: Applying the Law to the Example

- U.S. Residency vs. U.S. Tax Residency

- Standard green card holders are automatically considered tax residents for worldwide income.

- A Gold Card holder may be a resident for immigration purposes but not for foreign-income tax. This is an unprecedented carve-out.

- The Cost-Benefit Analysis

- Immediate Outlay: $5 million for a new Gold Card.

- Annual Savings: If our hypothetical Mother has $24 million in foreign income, the U.S. top tax rate of ~37% would otherwise cost her $8.8 million a year in federal taxes alone. Saving that each year dwarfs the initial payment.

- Estate Tax Implications

- If she is considered domiciled in Florida (a common scenario for wealthy celebrities), her worldwide estate could still face federal estate taxes.

- However, because there’s no Florida state estate tax, any additional estate or inheritance taxes come from the federal side. Planning with trusts or retaining her foreign assets in non-U.S. entities before establishing domicile may reduce her estate tax burden.

- Upgrading from Old Green Card

- Public statements indicate existing green card holders can upgrade. If you already have a standard green card, weigh whether you want to pay the fee to escape worldwide taxation.

- This choice hinges on projected future earnings, where they’re sourced, and whether you aim to become a U.S. citizen someday (since citizenship cancels out the foreign-income exemption).

Why I Care About Estate Planning for Global Families

I became a lawyer because of a personal, painful loss in my own family—when my grandfather passed, our lack of legal guidance tore us apart. That experience led me to fight for families, ensuring the law protects rather than destroys. When I read about brand-new options like this Gold Card, I see how it might protect wealth, but I also think about fairness, planning, and clarity. My clients—whether they’re celebrities or everyday families—come to me because they need someone who cares deeply about both the technicalities of the law and their emotional well-being.

Trust is the foundation of every attorney-client relationship. I strive to earn that trust by staying on top of developments like these immigration pathways, explaining them in plain English, and making sure people choose what’s truly in their best interest. If that means exploring an innovative visa, great. If it means focusing on simpler estate planning strategies—like irrevocable trusts, living wills, or Medicaid planning—that’s equally valid.

Common Mistakes & How to Avoid Them

- Underestimating Estate Taxes

- Mistake: Failing to plan for federal estate taxes if you’re domiciled in the U.S.

- Solution: Use trusts, strategic gifting, and other planning tools under Florida Statutes (e.g., Chapter 736 for trusts; Chapter 732 for wills and estates) to safeguard assets.

- Assuming the Gold Card Covers Everything

- Mistake: Believing all taxes vanish entirely.

- Solution: Remember, U.S.-sourced income is still taxable. Also, if local laws abroad impose taxes, you could still owe money there. Engage a cross-border CPA or tax attorney for comprehensive planning.

- No Long-Term Care Plan

- Mistake: Wealthy individuals thinking Medicaid planning isn’t relevant.

- Solution: Even high-net-worth families can face skyrocketing nursing home bills. Florida Medicaid has specific look-back periods (5 years). Plan ahead to protect your family’s financial security.

- Waiting Until Crisis Hits

- Mistake: Trying to fix estate matters or upgrade immigration status in an emergency—like a sudden lawsuit, major health crisis, or catastrophic tax assessment.

- Solution: Seek legal counsel early to mitigate risks, reduce taxes, and preserve family harmony. Proactive planning is always cheaper and more effective.

Disclaimer & Important Note

This article is for informational purposes only. It does not create an attorney-client relationship. The only way to create an attorney-client relationship with me is to receive a signed writing from me stating that I agree to represent you.

Wealthy families and international investors need an attorney to provide strategic estate tax planning.

Families suffering expensive long-term-care need an attorney for Medicaid crisis planning.

Beneficiaries who inherit a home and see property taxes jump need an attorney to fight to lower their tax bill.

I write wills, trusts, powers of attorney, and health care surrogates.

If you need letters of administration, I represent you in probate.

Had a tough probate? I can appeal it.

Contact Me

You have three ways to get in touch with me:

- Call me at (305)634-7790

- Email me at JO@JOValentino.com

- Fill out the contact form at www.JOValentino.com/contact

I’m here to answer your questions, help you navigate complex laws, and secure your family’s future. Let’s chart a path forward—together.

FAQ

-

How could Shakira benefit from the Gold Card?

With most of her income earned outside the U.S., Shakira could potentially save millions in U.S. taxes using the Gold Card’s exemption on foreign income.

-

Does the tax exemption apply to all of Shakira’s income?

No. Only foreign-earned income would be exempt. U.S.-based endorsements or performances would still be taxed.

-

Is the Gold Card available to the public now?

As of now, it’s based on public statements. Official USCIS policy or legislation is still evolving.

Share: